Dawna Wright is a good person to have on side in a crisis. Her CV details a decade as an expert witness in fraud and litigation cases and 20 years as a forensic accounting specialist delving underneath the accounts for the numbers that count in tricky disputes.

I am quite a competitive person generally so I don’t mind that adversarial role but it can get exhausting.

FTI Consulting has been operating in Australia since 2005 when it acquired Ringtail software, developed by a small Australian startup, now used by major law firms worldwide to capture and manage electronic information in investigations, litigation or regulatory enquiries. FTI Consulting’s next foray into the Australian market was strategic communications, followed by corporate finance. And last year Wright, who had moved to insolvency firm McGrathNicol five years before – after 17 years at Deloitte – was tapped to develop the forensic business.

“I knew FTI Consulting was going to move into this market and they would have to do it with somebody here. I looked at the strength of that brand overseas and thought: ‘Do I want to be competing against it or for it?’ My competitive nature kicked in. It seemed like a role that would bring together all the various things that I’d been doing up until now.”

Wright has a huge task ahead, expanding the practice from its Melbourne base to Sydney, Brisbane and Perth. Then there’s the business development side, connecting with law firms and companies who need these types of services. “Part of my job is finding the next job,” she quips.

Little decisions, big consequences

It’s hard to believe she’s a self-described “inner control freak”. Wright is warm and composed as she recounts the seemingly “little decisions” she’s made along the way that have led to her sitting in a Melbourne office plotting to take on the Big Four accounting firms and boutique insolvency businesses for a slice of the forensic accounting pie. One of the most pivotal of those “little decisions” involves her choice to move to Paris in the early 1990s. As a newly minted chartered accountant in Canada, Wright opted to spend 18 months in the City of Light on secondment from Deloitte. She had attended a French immersion school in Winnipeg and was effectively bilingual. “But I had to relearn my accent, which was French Canadian. When I got to Paris a few people said they didn’t understand me. They thought I was from Belgium,” she laughs.

It was in Paris she met her husband, Australian Peter Riedel, also a Deloitte secondee. When the pair left to head for Deloitte’s New York office Wright decided to get out of audit. Her first choice, M&A and corporate finance, was not an option as the senior partner decided he couldn’t have her and Riedel in the same division. She recalled a university fascination with law, so forensic accounting beckoned. “When I started I didn’t really know what it was, but soon after I realised I liked the puzzle-solving side and the switching between the high-level strategic thinking and the drilling down into the numbers.”

Forensic accounting

In broad terms forensic accountants help non-accountants with the numbers. “We have to be able to write in a way that lawyers and judges can understand, and in a compelling way,” explains Wright. “Most of the time language is just as important as the numbers and you have to be as good at writing as analysing spreadsheets, which is unusual for accountants,” says Wright.

She made her appearance as an expert witness in her first significant case 10 years ago in Queensland. “I had a two-month-old baby and was on maternity leave. The trial was supposed to be in September, it ended up being pushed back. I had a baby in December [Wright now has two sons aged 10 and seven]. I gave evidence in February so I had to bring the baby because I was breastfeeding and [also] bring my mum up with me, so she could care for him while I was in the witness box,” recounts Wright. She has since appeared as an expert witness in many cases, including for Woolworths and Crown and in the Toll and Patrick closed arbitration over a disputed joint venture arrangement involving losses in the region of $300 million-plus. She was also a member of an independent three-person senior review panel to assess certain claims arising from a class action related to the Black Saturday bushfires.

PREPARATION IS KEY

Such work, she says, is all about detailed preparation. “We will write a report and often six months down the track we are giving evidence on that report. The week before you need to go back over everything, retrace your steps and be on top of everything. That gives you the confidence to respond to opposing counsel who will try to trip you up by drawing out any inconsistencies.” She notes: “We need our game face on; we are always in hand-to-hand combat. I am quite a competitive person generally so I don’t mind that adversarial role but it can get exhausting. Everything we do is up for scrutiny with someone else going through it with a fine-tooth comb looking for errors.”

She also believes it’s the people behind the expert who help to save the day. “I consider it a team game, some people see it much more as an individual effort, but I believe I can’t do without the different skills and experience of the people on the team.” Such teams usually include investigators, data analysts and forensic accountants and Wright has spent the last year, since joining the firm as a department of one, building a team of nine, with more to come. She chose to cherry-pick her initial team, rather than bringing a department across to the firm – a familiar tactic played in professional service firms everywhere. “I was going for range. Some people are better at business development, others are more analytical, some are lateral thinkers, others are the ‘deep dive’ type. We needed a variety of management styles, [plus] gender and general diversity,” says Wright.

Of her management style she says she tries hard to quell her “inner task focus”. “I consciously try not to be too directive of people because I know I don’t like to be managed like that, so I probably go too much the other way in giving people too much leeway – it’s about balance.”

Recently at an FTI Consulting regional meeting in Hong Kong senior directors were put through their management paces in an exercise where their peers and staff rated them. When the seminar leader described the task-orientated personality, Wright thought: “That’s me, short of time, likes to get things done.” She was surprised to find that people rated her as expressive and extroverted. “I think of myself as being naturally introverted, but at work I don’t go with my natural tendency, which is to sit in the office and close the door. You can’t do that and lead a team.”

BOARD ROLES

Dawna Wright has sat of the boards of The Women’s Circus, Amnesty International Australia and IML Victoria. She is currently having a break from board work because of the travel demands of her current role. This is how she got started:

“My first board role came about by accident, but was the culmination of small decisions I made along the way. In New York I had quite a few friends who were involved with Amnesty International, either as employees or volunteers, so when I came to Australia I thought I would try to get involved with Amnesty here because I believe in the cause,” says Wright, adding it was on her to-do list for some time. When she did call to volunteer it was suggested she call the treasurer who was putting together an audit committee for the first time. “I then became treasurer, a board role, when the incumbent went overseas.”

HOW WRIGHT MANAGES

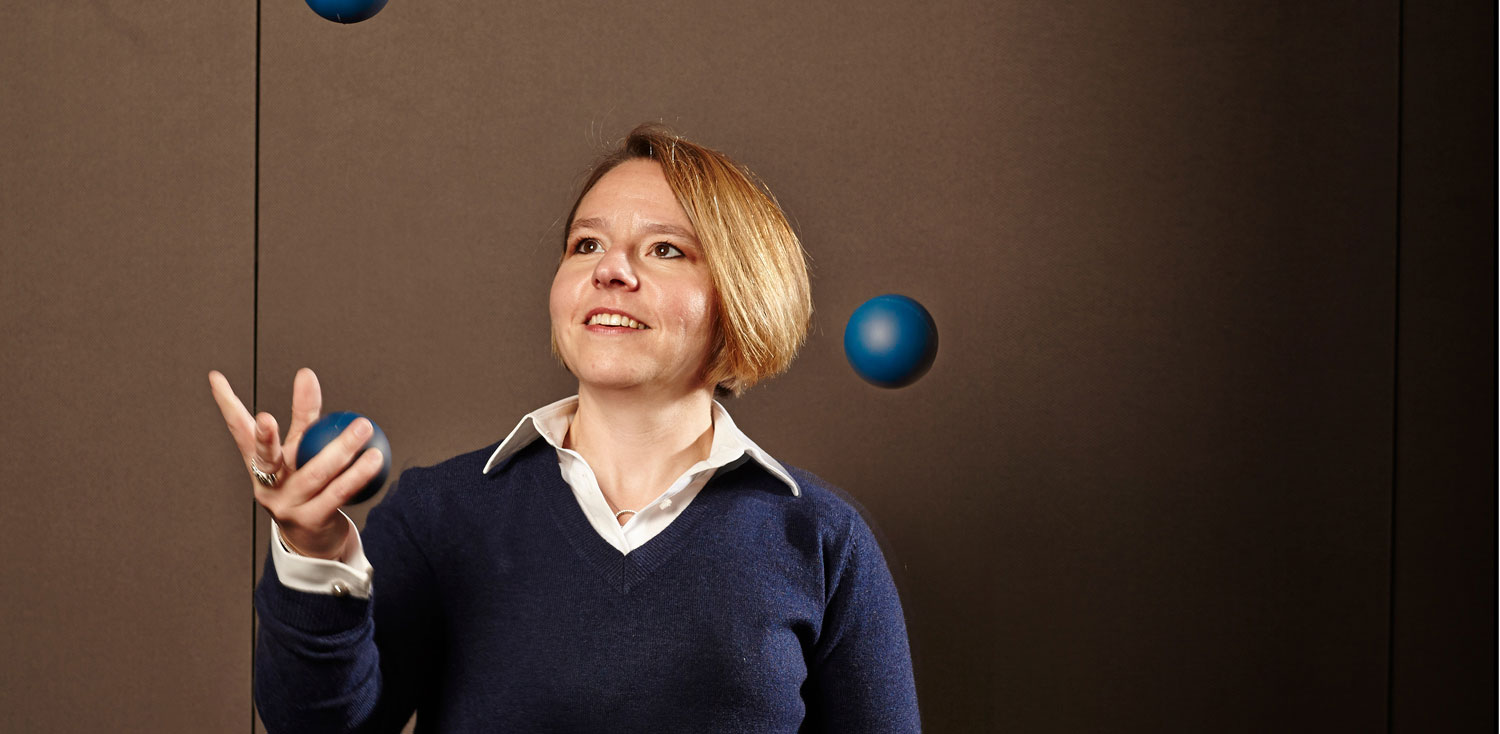

When asked how she juggles two small children, a demanding career and the odd board role, Wright says lightly: “I’ll answer this but only if you promise to ask the next man the same question.” She splits childcare 50:50 with her husband, “although now he probably does 70 per cent at the moment because I’m travelling a lot. When we had our first child I took six months off and then he took two months off, and in the first year we worked four days a week each and had a nanny for the other three days. It shouldn’t be just a woman’s responsibility to juggle, everyone should be juggling.”